Great Tips About How To Become A Cpa In Pennsylvania

Roger's energy + uworld's revolutionary qbank will help you get to the finish line.

How to become a cpa in pennsylvania. Received a bachelor's degree or higher from an accredited college or university. The state board of accountancy regulates the practice of public accountants and certified public accountants in the commonwealth of pennsylvania. Not required to be a us citizen.

Gain accounting knowledge to help you become a cpa with an online bachelor’s. Ad get real cpa exam questions and comprehensive explanations. Ad pass up to 4x faster with our adaptive technology.

Ad fastest 25% of students. Completed at least 24 semester credits in accounting subjects, including accounting and auditing, business. Save on a bs business w/ flexpath.

Pace & price vary—fees apply. Pennsylvania cpa exam age requirements. Pennsylvania cpa exam and license requirements:

Save up to 400 hours of study time. 7 simple steps to becoming a cpa in pennsylvania; To meet the pennsylvania cpa education requirements to sit for the cpa exam, you’ll need to have a bachelor’s degree accredited by a nationally recognized accrediting agency.

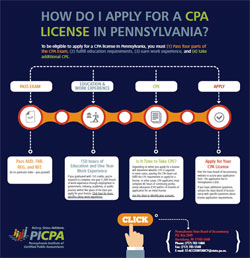

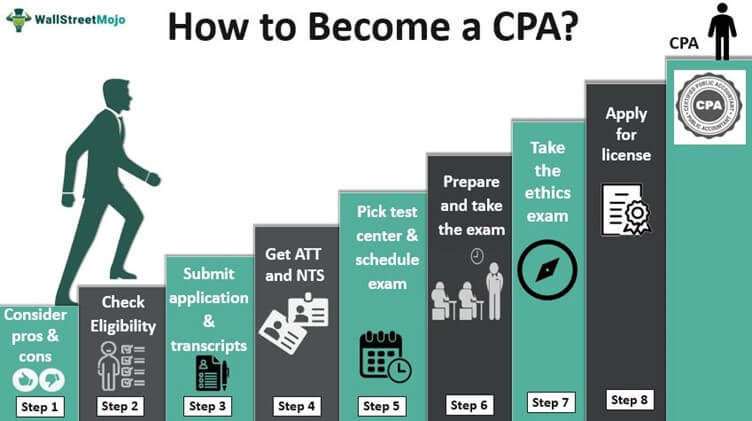

Steps and requirements to become a cpa in pennsylvania. There are five main steps to. An advisory evaluation will identify any academic deficiencies in your education before you submit a first.

![Pennsylvania Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Pennsylvania-CPA-Exam-Requirements.jpg)

![Pennsylvania Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Pennsylvania-CPA-Exam-Eligibility-Requirements.jpg)

![Pennsylvania Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Pennsylvania-CPA-Exam-Required-Documents.jpg)

![2022] Pennsylvania Cpa Exam And License Requirements [Important!]](https://i0.wp.com/www.cpaexammaven.com/wp-content/uploads/2019/05/Pennsylvania-CPA-Requirements.png?fit=640%2C400&ssl=1)

![2022 ] Pennsylvania Cpa Exam & License Requirements [Important Info]](https://crushthecpaexam.com/wp-content/uploads/2019/06/UStates-Images-14.png)

![Pennsylvania Cpa Exam & License Requirements [2022]](https://cdn.wallstreetmojo.com/wp-content/uploads/2021/11/Pennsylvania-CPA-Exam-License-Requirements.jpg)